How to Fill Cheque Deposit Slip SBI – The act of depositing a check at the State Bank of India (SBI) is a straightforward procedure that can be accomplished through a multitude of avenues.

In this guide on “How to Fill Cheque Deposit Slip SBI”, you can learn how to deposit a cheque in sbi bank with a bank slip provided by the state bank of India branch.

How to Fill Cheque Deposit Slip SBI?

The following steps outline the necessary measures to ensure a seamless and efficient deposit experience.

- Venture forth to your closest SBI location: The initial step necessitates a visit to your nearest SBI branch, armed with the check you wish to deposit.

- Compile a deposit slip: Once inside the branch, it is imperative to complete a deposit slip, which requires the inclusion of essential information such as your account number, name, and the deposit amount.

- Endorse the check: After the deposit slip is filled, the next step is to endorse the check by signing on its reverse.

- Hand over the check and deposit slip: With the endorsement of the check now complete, it is imperative to submit both the check and deposit slip to the teller for processing. The teller will verify the details on both the deposit slip and the check before proceeding with the deposit.

- Obtain a receipt: Upon successful processing of the deposit, the teller will issue a receipt as evidence of the transaction.

- Verify account balance: A few days post-deposit, one must confirm the crediting of the deposit by checking their account balance.

Depositing a check at SBI is a speedy and uncomplicated process that can be completed within a matter of mere steps.

A visit to your nearest SBI location, completion of a deposit slip, endorsement of the check, submission of both the check and deposit slip, receipt acquisition, and verification of the account balance are all that is required to ensure a seamless deposit experience.

How to Fill Cheque Deposit Slip SBI?

Depositing a cheque in SBI Bank may seem like an uncomplicated task, but it is imperative to exercise caution while completing the cheque deposit slip, as even the slightest mistake could lead to significant errors.

If you’re an inexperienced depositor, you may be intimidated by the prospect of filling out the deposit slip, but with this guide, you will learn the proper procedure to fill out the How to Fill Cheque Deposit Slip SBI with ease.

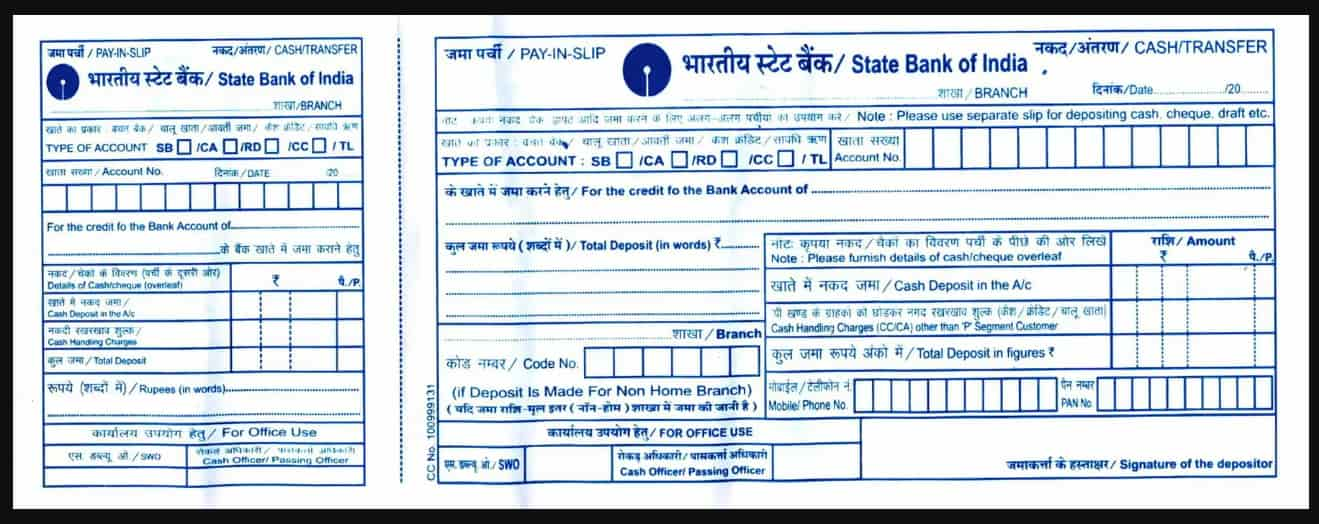

- The Dual-Sided Nature of the Cheque Deposit Slip

The cheque deposit slip of SBI Bank is divided into two sides, the front, and the back. On the front side, you will find two sections – the left and the right – both of which must be filled out with the following information.

Left Section:

- SBI Branch Name: Enter the name of the branch where you will be depositing the cheque.

- Date and Year: Specify the date of deposit.

- Account Number: Enter your account number, ensuring to fill in each digit in a separate block.

- Account Type: Select the type of account you possess (CA, RD, SB, TL, or CC).

- Name of Account Holder: Write your name as it appears in your account.

- Deposit Amount (in words): Write the amount being deposited in words.

- Deposit Amount (in numbers): Indicate the total deposit amount in numerical form.

- Optional: Include your mobile number if you wish.

- PAN Card Number: If the deposit amount exceeds INR 50,000, you must provide your PAN Card Number.

- Signature: Sign the deposit slip in the designated space.

Right Section:

- Name of Bank Branch

- Date, Month, and Year

- Account Number of SBI Bank

- Account Type: SB/CA/RD/CC/TL

- Account Holder Name

- Amount to be Deposited (in words)

- Amount to be Deposited (in numbers)

- Total Deposit Amount (in numbers)

- The information required in both the left and right sections is almost identical.

Back Side of the Cheque Deposit Slip

On the back side of the SBI cheque deposit slip, you must fill in the denomination of the total amount being deposited. Here is how to complete the back side of the slip:

- Write the denomination of the notes, starting with the highest note (INR 2000), followed by INR 500, INR 100, INR 50, INR 20, etc.

- For instance, if you have 6 notes of INR 500, write ‘6’ in the Pieces section and ‘INR 3000’ in the INR section.

- Repeat the same process for the remaining denominations.

- Sign the cheque deposit slip and submit it to the relevant counter in the bank branch.

- The bank executive will verify both the cheque and deposit slip, and if all details are found to be valid, they will stamp both sides of the slip.

- You will receive an acknowledgment slip as proof of your deposit.

Depositing a cheque in SBI Bank is a simple process if you have all the necessary bank details and ensure to fill out the cheque deposit slip correctly.

With the help of this guide, you will be able to fill out the deposit slip with accuracy, enabling you to deposit your cheque without any issues.

How Long Does It Take For A Cheque To Be Credited In SBI?

Depositing cheques in the State Bank of India (SBI), a leading public sector bank in India, requires a nuanced understanding of the process.

While there are multiple options available, such as depositing at a branch counter or utilizing a Cash Deposit Machine (CDM) within the branch, it’s crucial to keep in mind the prescribed cut-off time for same-day clearance.

This cut-off time is usually set such that, if you deposit the cheques before it, the amount will be credited to your account on the same day. Nonetheless, there may be exceptional cases where the clearance period may take up to 2 business days to reflect in your account.

It is worth noting that depositing cheques issued from non-home branches attract charges. For the majority of SBI account holders, the first 10 cheques in a financial year are free to deposit.

However, post utilizing the free cheques, the subsequent 10 cheques attract charges. Here’s a breakdown of the charges:

- For the next 10 cheques, the charges are Rs. 40 + GST

- For the next 25 cheques, the charges are Rs. 75 + GST

- For the first 10 cheques of the emergency checkbook, the charges are Rs. 50 + GST

- It’s noteworthy that senior citizens are not subject to the restriction of free cheques, and they can use checkbooks without any limits.

In summary, depositing cheques in SBI can be a smooth process if you keep in mind the cut-off time and charges for non-home branch cheques.

By adhering to these guidelines, you can deposit your cheques with ease and ensure that the amount is credited to your account promptly.

FAQs on How to Fill Cheque Deposit Slip SBI:

-

How Many Days Does It Take For Cheque To Get Cleared In SBI?

It may be simplified to state that the clearance period for most cheque deposits in the State Bank of India (SBI) is only 1 working day.

Nevertheless, there are circumstances that may cause a delay, resulting in a 2 business day wait for the amount to be credited to one’s bank account.

-

Are There Any Restrictions On Using Chequebooks In SBI?

A contradictory situation where senior citizens are exempt from any such restrictions, while other account holders may face limitations once they have utilized 10 free cheques in a financial year.

This incongruous state of affairs leaves one to ponder the complexities of the banking world.

-

How Much Will I Be Charged For The Subsequent Cheques In SBI?

The charges levied for the subsequent cheques in SBI can be a contentious issue, but rest assured, the charges are as follows: for the next 10 checkbook pages, customers will be charged Rs. 40 + GST, while for the next 25 checkbook pages, the charges will be Rs. 75 + GST.

Additionally, for the first 10 cheque leaves of the emergency checkbook, customers will be charged Rs. 50 + GST.

-

Is There Any Limit On The Number Of Cheques That Can Be Deposited In A Day?

It is a tricky one, as there is technically no limit.

However, it is always advisable to seek clarification from the bank regarding any potential restrictions on the number of cheques that can be deposited in a single day.

-

Is It Possible To Deposit Cheques After The Cut-Off Time?

It can be resolved by stating that it is not possible. Cheques deposited after the cut-off time will not be processed on the same day and will have to be processed on the following working day.

More SBI Bank Guides:

- How to Download SBI Bank Statement PDF

- How to Enable Online Transactions in SBI Debit Card

- How to Change Registered Mobile Number in SBI

Final Verdict:

To summarize, if you encounter any perplexing questions or concerns in relation to the process of depositing cheques with the State Bank of India, the bank’s frequently asked questions section serves as an invaluable resource to provide quick and satisfactory solutions.

It is also of utmost importance to carefully verify the information on How to Fill Cheque Deposit Slip SBI, to guarantee an effortless and efficient cheque deposit procedure.