Managing your Suddenlink bill pay on time is essential for a seamless experience with their internet, TV, and phone services.

In this article, we will delve into Suddenlink’s payment assistance programs, troubleshoot common billing issues, and offer tips for successful bill management.

Suddenlink Bill Pay

Suddenlink Communications is a leading provider of internet, television, and phone services.

As a Suddenlink customer, managing your bill effectively is vital for a hassle-free experience.

This article aims to guide you through the Suddenlink bill payment process, ensuring a smooth and convenient journey.

Understanding Your Suddenlink Bill:

Your Suddenlink bill comprises several sections that provide essential information about your account. These sections include:

- Account information: It includes your account number and contact details, facilitating quick identification.

- Billing period and due date: The bill clearly specifies the billing period and the deadline for payment to avoid late fees.

- Summary of charges: This section provides an overview of the total amount due, including the subscription fees for each service you have.

- Itemized charges: It presents a breakdown of charges for individual services such as internet, TV, and phone, along with any additional features or equipment charges.

- Extra fees and taxes: Details regarding any applicable taxes, regulatory fees, or surcharges are included in your bill.

- Payment alternatives and directions: This section provides detailed directions on the payment strategies accepted by Suddenlink, delivering stepwise directions on how to make a payment.

Payment Options:

Suddenlink offers various convenient payment options tailored to your preferences. These include:

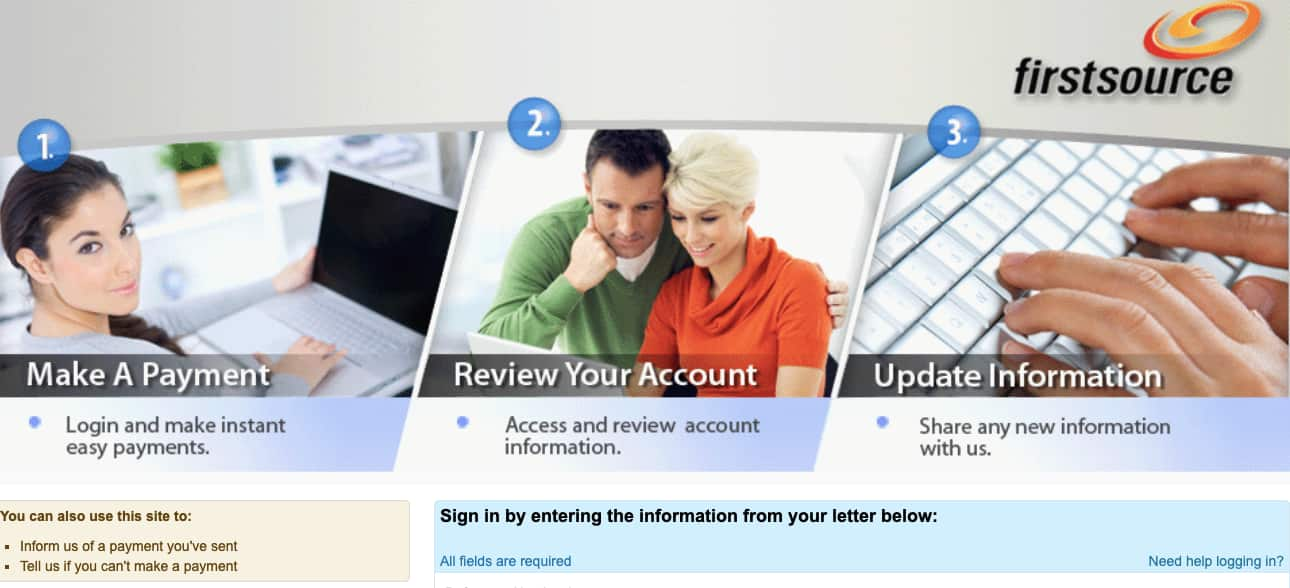

Online Payment:

- Setting up an online account: Begin by creating an account on the Suddenlink website, providing your account number and other necessary details.

- Logging into your online account: Once your account is successfully set up, securely login to access your bill and have complete control over your payments.

- Reviewing your bill online: Your online account allows you to access detailed billing information, enabling you to review charges and ensure accuracy.

- Making an online payment: Suddenlink’s user-friendly online payment portal facilitates electronic bill payment using credit/debit cards or bank accounts.

- Autopay enrollment: Simplify your bill-paying process by enrolling in Suddenlink’s Autopay service, ensuring automatic payment on the due date.

Payment by Phone:

- Contacting Suddenlink’s customer service:

Contacting Suddenlink’s customer service helpline, where an agent will help you with the payment method.

- Payment method over the phone:

Just provide the necessary details, including your account number and payment details, to finish the transaction.

- In-person Payment:

Locating Suddenlink payment centers: If you prefer to make payments in person, find the nearest payment center using the Suddenlink website or customer service.

- Payment strategies accepted at payment centers:

Suddenlink payment centers normally accommodate a scope of payment alternatives, including cash, checks, money orders, and credit/debit cards.

What to bring for in-person payments:

When visiting a payment center, ensure you have your account number and chosen payment method readily available for a seamless transaction. By understanding and utilizing these payment options, you can choose the method that suits you best and ensure timely bill payments.

Understanding the Suddenlink bill payment process is essential for a smooth customer experience. By familiarizing yourself with your bill, exploring the available payment options, and following the provided guidelines, you can effectively manage your payments.

Should you experience any issues or need further assistance, feel free to contact Suddenlink’s customer service for help.

Payment Assistance and Programs:

A. Suddenlink Payment Arrangements:

If you find it challenging to pay your bill in full, Suddenlink offers payment arrangements to ease the burden.

Here’s what you need to know:

- Overview of payment arrangement options: Suddenlink provides flexible arrangements that allow you to pay your bill in installments over a specified period.

- How to request a payment arrangement: Contact Suddenlink’s customer service to discuss your situation and request a payment arrangement tailored to your needs.

- Eligibility criteria and limitations: Payment arrangements are evaluated on a case-by-case basis, considering factors such as your account history and outstanding balance.

B. Low-Income Assistance Programs:

- Suddenlink also participates in government-sponsored programs designed to provide support to low-income individuals and families:

- Details on government-sponsored programs (e.g., Lifeline): Programs like Lifeline aim to offer discounted or subsidized services, helping eligible households afford essential communication services.

- How to qualify and apply for low-income assistance:

To determine eligibility and apply for such programs, visit the program’s website or contact the relevant government agency for detailed information.

Benefits and limitations of these programs:

Low-income assistance programs provide financial relief, but it’s important to understand their specific benefits, limitations, and requirements for continued eligibility.

Troubleshooting Common Billing Issues:

Billing discrepancies or errors:

Mistakes can happen on your bill, but you can take steps to rectify them:

- Checking for accuracy in charges: Carefully review your bill and ensure the charges align with the services you have subscribed to. If you notice any discrepancies, contact Suddenlink’s customer service to address the issue.

- Disputing incorrect charges: If you believe there is an error on your bill, gather supporting documentation and contact Suddenlink promptly. They will investigate the matter and rectify any billing errors.

Late payments and penalties:

Avoid late payments and potential penalties by staying informed about due dates and payment options:

- Understanding late payment fees: Familiarize yourself with Suddenlink’s late payment fees and policies to ensure timely payments and avoid additional charges.

- Minimizing penalties and potential service disruptions: Set reminders for bill due dates, consider enrolling in autopay, or explore payment options that best align with your financial situation. Prompt payment is crucial to prevent service disruptions.

Account management and bill notification:

Efficient account management and staying updated on bill notifications are vital for a smooth billing experience:

- Updating personal information and contact details: Keep your account information up to date with accurate contact details to receive important notifications and ensure effective communication with Suddenlink.

- Setting up bill notifications and reminders: Take advantage of Suddenlink’s bill notification options, such as email or text alerts, to stay informed about bill due dates and avoid missed payments.

More Related Guides:

Conclusion:

Understanding Suddenlink bill pay processes, including payment assistance programs and troubleshooting tips, is essential for smooth financial management.

By utilizing payment arrangements and low-income assistance programs when needed, and promptly addressing billing discrepancies, you can navigate your Suddenlink bill with confidence.

Additionally, staying informed about due dates, exploring payment options, and keeping your account information updated will contribute to successful bill management.