In a world where the digital revolution brings forth a plethora of conveniences, it simultaneously unveils a cascade of vulnerabilities, particularly revolving around the delicate act of personal information exchange during financial transactions.

A palpable apprehension penetrates the air as individuals, perhaps including yourself, engage in transactions even of a modest nature, such as those scarcely eclipsing a mere hundred dollars, inevitably intertwining with an unavoidable divulgence of intimate financial details.

Enter the SecureSpend Card – a veritable shield against the multifaceted perils of digital monetary exchanges. This stalwart of financial security does not discriminate between the varied nuances of daily expenses; be it the quiet enjoyment of a delectable restaurant meal, the mechanistic process of refueling your vehicle, the infinite wanderings amidst the vast expanse of the digital shopping universe, or the tactile exploration through the tangible realms of in-store retail.

SecureSpend.com

We invite you to immerse yourself into a thorough exploration of this financial tool within the subsequent passages, unearthing the systematic methodologies for activating your SecureSpend Card, decoding its intricacies regarding payment modalities, and unmasking its ubiquity in serving your everyday spending across the nation.

With a lens focused intently on elucidating the many facets of the SecureSpend Card, this narrative shall serve as a singular, comprehensive guide.

Embark upon this enlightening journey with us, weaving through detailed insights and emerging with a tapestry of knowledge, encapsulating not merely solutions but a holistic understanding of your financial safeguard in the digital epoch.

What is a SecureSpend card, and how do I get one?

In the multifaceted arena of fiscal dealings, SecureSpend arises not merely as a product but as an exemplar of stringent financial and informational safeguarding. Conceived as a prepaid gift card, it epitomizes a fortress that stalwartly safeguards every nuance of your transactions, steadfastly negating the obligatory disclosure of your intrinsic credit/debit credentials and other pertinent personal details, traditionally deemed indispensable for monetary maneuvers.

The journey towards procuring a SecureSpend card is eloquently straightforward, devoid of convoluted procedures or serpentine routes. It’s an experience characterized by its utter simplicity and intuitive access through an extensive network of retailers, lavishly sprinkled across the entirety of the United States, each being a conduit towards this robust financial protector.

Thus, the commencement of your voyage towards secure transactional experiences potentially unfurls at the threshold of a conveniently located retailer, enveloped within an aura of consumer-centricity and liberated from cumbersome registration undertakings.

Provided herein is an exhaustive list of SecureSpend.com retail outposts, meticulously distributed across the vast landscapes of the U.S., curated to facilitate a breezy navigation toward your proximal or desired retailer.

Thus, acquiring your SecureSpend card transforms into a pursuit free from bureaucratic labyrinths and administrative encumbrances, ensuring your pathway toward financial security remains uninterrupted and unequivocally straightforward.

Embark with SecureSpend on a meticulously crafted journey, submerging yourself into a realm where each transaction pulsates with a harmonized blend of safeguarded ease and tranquility, scrupulously designed to shield your data whilst simultaneously bestowing upon you the serenity of unrestrained, secure expenditure.

The tapestry of SecureSpend unravels not just as a product, but as a multifaceted financial ally, echoing with harmonies of absolute security, and framed with the unwavering commitment to protecting your personal and financial realm from the conceivable vulnerabilities embedded within the digital age.

How do I Activate my SecureSpend Prepaid Card?

Step into the realm of SecureSpend, where your financial transactions are not only streamlined but also fortified with an impermeable shield of security.

The commencement of this fiduciary journey beckons a pivotal first stride: the activation of your SecureSpend.com Card. Characterized by its succinctness and potent efficacy, the process of card activation is seamlessly integrated, echoing the facility experienced during the card’s procurement.

In the ensuing discourse, we meticulously delineate the three singular pathways, specifically crafted to usher your SecureSpend prepaid gift card into operational readiness:

- Activation in Store: A straightforward in-store activation can be achieved by presenting your card to the cashier amidst the transactional process, ingeniously intertwining payment and activation into a unified action.

- Online Activation: A virtual activation gateway awaits at Securespend.com, designed to facilitate your card’s activation with a blend of digital acumen and operational simplicity, ensuring your fiscal endeavors are not stalled.

- Autonomous Activation: Embrace the simplicity of the auto-activation mechanism, whereby your card, autonomously and inconspicuously, activates within a concise 24-hour timeframe following its acquisition, thereby ensuring readiness sans any explicit action.

Encapsulated herein are the exclusive, validated conduits through which the functionality of your SecureSpend prepaid gift card is ignited, each pathway articulated with a meticulous blend of user-friendliness and uncompromised security.

In a digital epoch, where illusory platforms may beckon alternative activation methodologies, the judicious shield of skepticism and adherence to official channels is paramount. Refrain from capitulating to the allure of divergent online promises, strategically safeguarding yourself from potential pitfalls crafted by nefarious digital entities.

SecureSpend.com stands not merely as a financial instrument but as an unwavering ally in your transactional journeys, enveloping your fiscal interactions with a fortified cloak of reliability and serene confidence, propelling you forward into a domain where each transaction is a synthesis of effortless simplicity and reinforced security.

How do I use my SecureSpend prepaid card?

In the sprawling landscape of transactional ease, the SecureSpend card orchestrates a symphony where utter convenience and an inexhaustible array of applications dance in harmonious unison!

Envision a tool that meanders through various facets of your financial life – be it navigating through the seamless avenues of online bill settlements, accommodating your vehicular fuel needs at gas stations, or expressing your financial appreciation through tips at dining establishments; the SecureSpend prepaid card unveils itself as a splendidly versatile monetary instrument.

A Gentle Admonition: It’s imperative to note that certain payment methodologies when maneuvered via SecureSpend gift cards, may temporarily immobilize up to 20% of the transactional value.

The SecureSpend card effortlessly waltzes through the domains of both online and physical storefront transactions. Permit us to delve into a deeper exploration of each transactional milieu:

The Realm of Online Transactions:

- Before immersing oneself in the digital shopping experience, ensure a meticulous verification of the SecureSpend card’s existing balance, assuring it surpasses the entirety of the prospective purchase, encompassing all supplementary charges and taxes.

- Consciously select Debit/Credit as your desired method of payment, avoiding the temptation to select the Gift Card option.

- Tender the requisite card information judiciously.

- Diligently fill in your personal and address details within the Billing Address segment. And there it is, your first purchase via the SecureSpend prepaid card has been gracefully concluded.

An Important Caveat: The SecureSpend prepaid card remains ineligible for engaging in recurring financial obligations, including memberships or subscription services.

Exploring In-Store Transactional Experiences:

- As you edge towards finalizing a purchase, graciously present your SecureSpend card to the cashier, maintaining an acute awareness of its prevailing balance.

- Choose to conclude your purchase by opting for Credit and ceremoniously affixing your signature to the receipt. (An online vista of your transactions is available for perusal via your SecureSpend account.)

- Alternatively, your transaction may be brought to culmination by selecting Debit and discreetly inputting your card’s PIN. (The PIN may be managed and manipulated online, facilitated through your SecureSpend account.)

Embark with SecureSpend on a journey where every transaction, whether a minute everyday expense or a significant purchase, is ensconced in a cocoon of sublime simplicity and robust security, effectively transforming every financial engagement into a remarkably serene and reliably secure experience.

How do I Split Transactions using my Secure Spend prepaid card?

Occasionally, we meander into scenarios where the financial wellspring of a SecureSpend prepaid card might tenderly flirt with inadequacy, presenting an intriguing juncture wherein the strategic implementation of a split transaction burgeons into a viable, and sometimes necessary, alternative.

During such monetary endeavors, you, the astute spender, may opt to elegantly intertwine your payment with a secondary modality – perhaps cash, check, credit, or debit – delicately crafting a bridge over the chasm of fiscal discrepancy.

The artistry of dual-faceted transactions necessitates a thread of transparent communication with your merchant, a vital conduit ensuring the smooth orchestration of your purchasing experience.

It becomes paramount to pre-emptively alert your merchant upon deciding to caress the tendrils of a split transaction, furthermore providing a meticulously detailed exposition regarding the exact pecuniary partition intended for each method of payment.

This meticulous forethought promises a fluid, symbiotic dance between client and merchant, unmarred by financial missteps or misunderstandings.

Note: A gentle reminder that the acceptance of split transactions stands firmly rooted in the merchant’s policies and propensities. A kaleidoscope of attitudes toward payment methodology prevails; some entities may bask in the simplicity of cash to mitigate the remaining balance, while others steadfastly persist in their allegiance to debit resolutions.

Thus, engagement in a preemptive, insightful dialogue with your merchant emerges not merely as recommended but essentially quintessential, illuminating potential transactional variances and ensuring your journey through the realm of split transactions is both enlightened and devoid of unexpected nuances.

How do I Check the Balance on my SecureSpend Card?

Sailing through the digital waves to decipher the numerical depths of your SecureSpend prepaid card balance is an endeavor that encapsulates not only sheer simplicity but also expedient efficiency, ensuring that the revelations of your fiscal standing are but moments away.

Let’s delve deeper into the meticulous steps that pave the way to this monetary enlightenment:

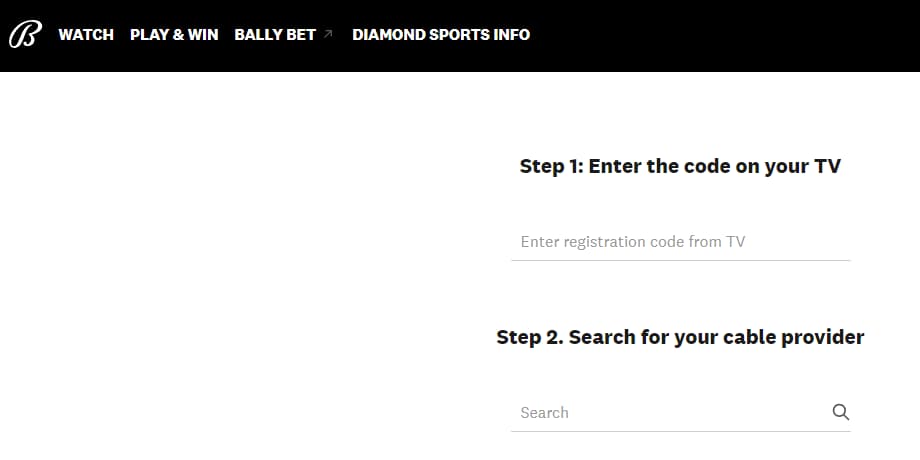

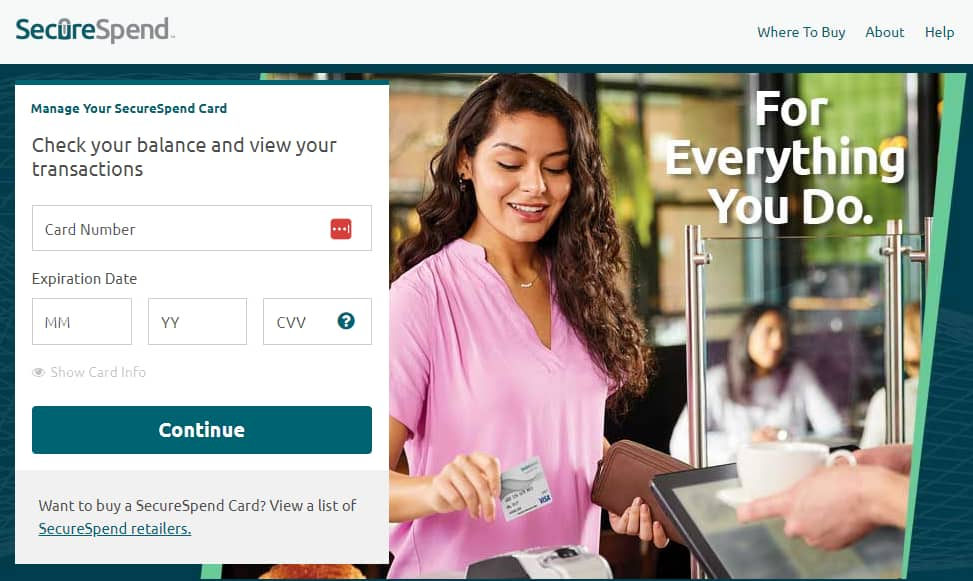

- Initiation Step: Direct your browser’s helm to the official cybernetic domain of SecureSpend, which resides at www.securespend.com, acting as your initial gateway into your fiscal explorations.

- Data Entry Step: As the digital landscape presents you with a form, tenderly populate it with your card’s intrinsic financial identifiers – the 16-digit numerical string that christens your card, its expiration date, and the covertly secure CVV.

- Progression Step: Subsequently, bestow a click upon the ‘Continue’ button, chartering forth into your financial discovery.

In an alternate sea of possibilities, the melodious echos of telecommunication present a further pathway towards unearthing your balance. Simply entwine your communicative endeavors with the toll-free number 1-833-563-8200, whereupon the realms of SecureSpend shall divulge the mysteries of your current balance with effortless grace.

This layered guide, with its comprehensive approach and illustrative language, assures that every holder of a SecureSpend prepaid card is expertly equipped to explore the extent of their monetary boundaries with confidence and ease, be it through the digital corridors of the internet or the timeless waves of telephonic dialogue.

Where to Buy a SecureSpend Card?

- CVS Pharmacy

- Walmart

- Walgreens

- RiteAID

- Dollar General

- 7 Eleven

- Family Dollar

- Exchange

- Sam’s Club

- Duane Reade

- Cumberland

- H.E.B

- Fred’s

- Sheetz

- More

SecureSpend Customer Support:

- 1-833-563-8200

Or write to:

- SecureSpend Customer Care

PO Box 826

Fortson, GA 31808

Also Check:

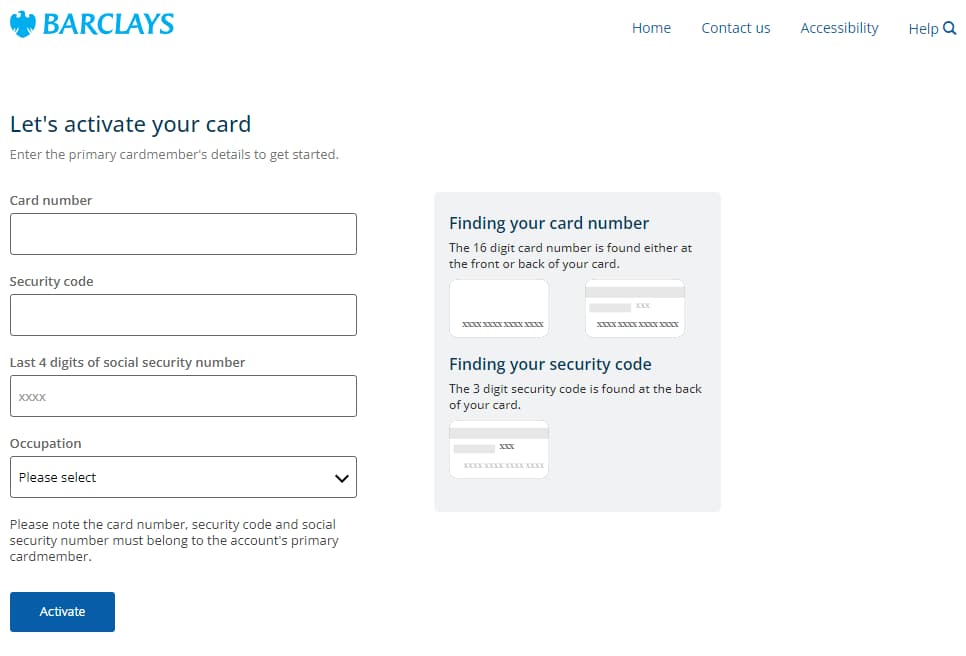

- Forwardline com Activate

- Destinycard.com/Activate

- JetBlueMasterCard.com Activate

- Login.NorthLane.com/Activate North Lane Card

- Activate.SYW.AccountOnline.com Login

- ReiMasterCard.com/Activate

Conclusion:

As we stand at the threshold of our discourse, it is crucial to underline the profound significance of activating your Secure Spend Visa Debit Card with SecureSpend. This seemingly simple act is, in reality, the opening of a portal that leads to a world characterized by two paramount attributes: financial convenience and unassailable security.

The choice is yours: whether you opt for the digital embrace of online activation or seek the guidance of human touch through customer support, the rewards of this card are destined to be manifold.

At its core, Secure Spend Visa Debit Card activation is the epitome of simplicity. It is your key to unlocking an array of financial conveniences, ensuring your money is readily accessible and your transactions are executed with precision. No more enduring lengthy waits for your card to become operational; as soon as it’s activated, it stands ready to serve your financial needs.

Amidst the digital age’s ever-present concerns about security, SecureSpend takes your protection seriously. Robust security protocols are employed to safeguard your financial information, making every transaction a secure and worry-free experience.

With an activated card, you’re not just accessing funds; you’re gaining access to a suite of financial management tools. Check your balance, track your spending, and enjoy the ease of digital financial control.

In parting, consider this a clarion call to action. Delaying your Secure Spend Visa Debit Card activation is merely postponing your financial liberation. By activating it today, you embark on a journey marked by confidence and peace of mind.

Your financial voyage awaits and promises to be secure and effortlessly enriching. Don’t let this opportunity pass you by – seize it with determination and step into a world where your financial well-being is at the forefront.

Activate your Secure Spend Visa Debit Card now at SecureSpend.com and embark on a secure and effortless financial journey that offers confidence and peace of mind in abundance.