The Target Credit Card Login process, much like other facets of the digital age, has evolved into a seamless experience for users. It is not just an entryway but a gateway to a myriad of exclusive offers, rewards, and transaction details. For those who are newcomers to this experience, initiating the Target Credit Card Sign Up is the precursor. This sign-up phase, integral to creating your unique Target Credit Card Account, is designed to be intuitive.

However, as streamlined as these processes are, it’s essential to approach them with a dash of prudence. One should always ensure a secured connection when attempting to log in. Moreover, familiarizing oneself with the layout and functionalities of the login portal can mitigate potential discrepancies in the future.

In essence, the journey from Target Credit Card Sign Up to regular Target Credit Card Login is not merely transactional. It’s a commitment to a more organized, rewarding, and efficient way of managing one’s finances with Target. And as with all commitments, the more informed and cautious you are, the more fruitful the relationship.

Target Credit Card Login

Advantages of Target Credit Card

Peeling back the layers, one uncovers the manifold benefits of the Target Credit Card. It’s not just a tool, but a gateway to exclusive offers and discounts that make every shopping trip a potential treasure trove of savings.

Beyond instant discounts, it’s a vessel for cashback and loyalty rewards that sow seeds for future gains. The cherry on top? The state-of-the-art online account management interface offers users unparalleled oversight of their spending patterns and balance details.

Initiating Your Online Journey with Target Credit Card

Before you embark:

- Prerequisites for registration: Gather necessary documentation such as personal identification and card details.

- Step-by-step registration guide: Navigate to the official website, locate the registration portal, enter the required details, and set a strong password.

- Faced a hiccup? Dive into the resources provided for troubleshooting common registration issues, guaranteeing a smooth transition into the digital sphere.

Accessing Your Digital Financial Realm

To delve into your account:

- Start by navigating to the login page via the official Target website or bookmarked pages.

- Promptly input your unique login credentials.

- Always, without fail, ensure a secure login environment. This can be achieved by checking for the HTTPS protocol or using a trusted VPN service.

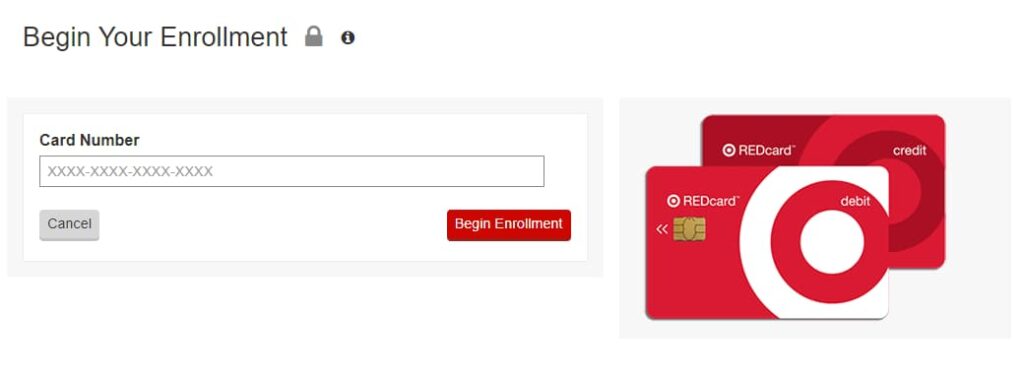

Target Credit Card Registration: A Step-by-Step Guide

- Begin with the Basics: Before starting your registration process, gather necessary documents like personal identification, proof of address, and of course, your shiny new Target Credit Card. This pre-preparation ensures a seamless sign-up experience.

- Navigate the Terrain: Access Target’s official website. Once there, look for the “Credit Card” section, usually positioned at the site’s footer or within the main menu.

- Kickstart the Process: Within the Credit Card section, spot the “Register” or “Sign Up” option, beckoning you to begin.

- Detail Time: As prompted, input personal details with precision. This might include your card number, name, date of birth, and Social Security Number.

- Create a Virtual Identity: Now, you’ll be asked to choose a username and a strong password. Remember, this combination is your key to accessing benefits later on.

- Security Questions: To fortify your account, you’ll likely need to select and answer security questions. These serve as an extra layer of protection, ensuring only you can access your account.

- Communication Preferences: Choose how you’d like to hear from Target. Email, SMS, or postal mail? The ball’s in your court.

- Read & Acknowledge: Don’t skim past the terms and conditions! It’s vital to understand the rules of the game. Once you’ve grasped the intricacies, provide your acknowledgment.

- Finalize Registration: With all details filled, submit your registration. Wait for an acknowledgment message or email.

- Log in for the First Time: Now that you’re registered, it’s recommended to log in immediately, ensuring all details are correct and the process is successful.

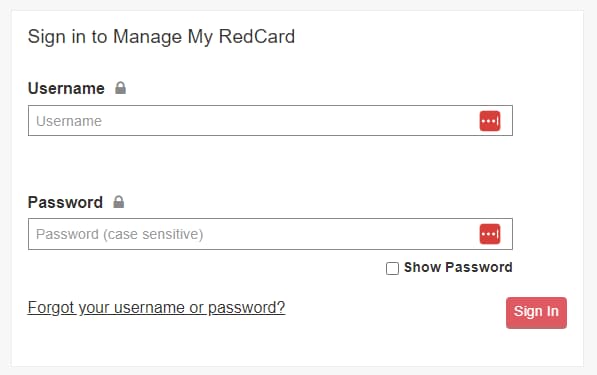

Target Credit Card Login: Simplifying the Process

- Start Right: Always use a secure internet connection. Whether at home or in a cafe, ensuring a protected network is the first step to a secure login.

- Official Portal Only: Always access Target’s official website for login. Avoid using links from emails or text messages which can sometimes be phishing traps.

- Locate the Sign-In Option: Once on the website, navigate to the Credit Card section. Here, the “Login” or “Sign In” button will be prominently displayed.

- Enter Credentials: Input your chosen username and password. It’s key to type this manually rather than relying on saved information, especially on shared computers.

- Two-Step Verification: If enabled, this feature will require an additional step, usually a code sent to your email or phone, which must be entered for access.

- Troubleshoot with Care: In case of failed login attempts, resist trying multiple times in quick succession. This can lock you out. Instead, reset your password or contact customer support.

- Keep an Eye on Alerts: Once logged in, check for any important notifications or alerts. This can include updates to terms, exclusive offers, or important account-related information.

- Log Out After: Especially on public computers, always log out after completing your session. This simple act can protect you from unauthorized account access.

- Regularly Update Passwords: As a best practice, update your password periodically. This refresh adds an additional security layer to your account.

- Stay Updated: Occasionally, Target may overhaul its user interface or introduce new security features. Keeping yourself updated ensures you always have a hassle-free login experience.

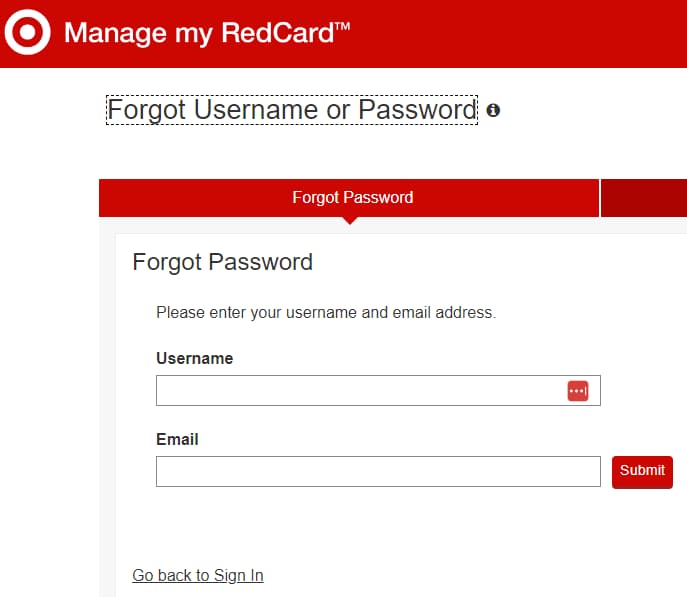

How to Recover Password of Target Credit Card Login?

Recover Password on official website:

- First, recognize the signs of a forgotten password—an inability to access your account or consistent error prompts can be clear indicators.

- Venture into the platform’s designated password recovery section.

- For the future, contemplate our advanced tips for creating memorable passwords, such as integrating symbols with familiar phrases or using a password manager.

How to Make Target Credit Card Payments Online?

Online payments epitomize modern convenience:

- The benefits of online payments include instant transaction processing and easy tracking.

- For occasional expenses, set up one-time payments via the portal.

- For bills or subscriptions, establish automatic recurring payments.

- Post-transaction, always ensure you receive a confirmation of successful payments via email or text.

Comprehensive Online Account Management

Dive deep:

- Periodically update personal information to reflect current details.

- Frequently skim through your balance and transaction history to be abreast of your finances.

- As your financial comfort grows, request a credit limit increase to match your spending potential.

- Adopt a proactive stance and monitor for fraudulent activities using alerts and transaction tags.

Target Credit Card Mobile App

Harness the might of your smartphone:

- Explore the multifaceted Target Credit Card mobile app with features ranging from fingerprint login to in-app offers.

- Head to your device’s app store, search, and proceed with downloading and installing the app.

- Contemplating a mobile app vs. a web portal? Remember, while the portal offers a widescreen view, the app offers unparalleled accessibility.

How to Make Target Credit Card Payments on Phone?

A blend of traditional and modern:

- Arm yourself with the official dial-in details for phone payments.

- Follow the guided step-by-step instructions for phone payments via an automated system or human representative.

- Post-transaction, await a vocal or text-based payment confirmation.

How to Make Target Credit Card Payments on Address?

For those inclined towards the tangible:

- Pen down the exact address details for mailing.

- Choose from the spectrum of acceptable payment methods by mail.

- Keep in mind the processing time for mailed payments can be longer, so factor in a buffer.

What are the Fees and Charges of Delayed Payments?

Be aware and prepared:

- Familiarize yourself with the potential fees and charges associated with delayed payments.

- Understand the ramifications a late payment can have on your credit score.

- Embrace strategies for avoiding late payments, such as setting up reminders or auto-debits.

Fortifying Your Digital Fortress

Safety cannot be compromised:

- Set up two-factor authentication, intertwining another layer of security.

- Activate alerts and notifications for real-time transaction monitoring.

- Educate yourself on identifying phishing scams—always check sender details and avoid clicking dubious links.

Troubleshooting: A Guide

For turbulent times:

- Address declined payments by verifying account balance and card expiration dates.

- Investigate unrecognized charges by cross-referencing with personal records.

- In the unfortunate event of misplacement or theft, immediately proceed with reporting a lost or stolen card to safeguard your finances.

Elevating Your Card Experience

Milk every benefit:

- Consistently track exclusive offers via newsletters or app notifications.

- Stay in the loop with partner brands and discounts through collaborative promotions.

- Master the nuances of earning and redeeming reward points to optimize every purchase.

Top 10 Target Credit Card Alternatives

Certainly! Here’s a list of 10 alternative credit cards to the Target Credit Card, each with its unique features and benefits:

- Walmart Credit Card: Issued by Capital One, this card offers cashback rewards for purchases made at Walmart stores and Walmart.com. The card also provides rewards for dining and travel purchases.

- Amazon Prime Rewards Visa Signature Card: A great choice for frequent Amazon and Whole Foods shoppers. Cardholders get 5% back on Amazon.com and Whole Foods purchases, as well as rewards for dining, gas stations, and drugstores.

- Costco Anywhere Visa Card by Citi: Besides rewards for Costco purchases, this card offers cash back on gas, dining, and eligible travel purchases.

- Kohl’s Charge Card: If you’re a frequent Kohl’s shopper, this card offers significant discounts on purchases throughout the year.

- Macy’s Credit Card: Macy’s cardholders can earn rewards for their purchases and also get access to special offers and discounts.

- Gap Visa Credit Card: For those who shop across the Gap family of brands (Gap, Old Navy, Banana Republic, and Athleta), this card offers rewards and special benefits.

- Best Buy Visa Card: This card provides shoppers with rewards for every purchase made at Best Buy and also offers rewards for dining and grocery purchases.

- Lowe’s Advantage Card: Home improvement enthusiasts might benefit from the discounts and special financing offers that come with this card.

- TJX Rewards Credit Card: Shoppers at T.J.Maxx, Marshalls, HomeGoods, and Sierra Trading Post can earn rewards for their purchases.

- RedCard at American Eagle: Fashion-forward individuals who shop at American Eagle or Aerie can avail of benefits and rewards with this card.

Each of these cards has specific advantages, depending on where you frequently shop. It’s always a good idea to carefully review the rewards, interest rates, and terms of each card to determine which one aligns best with your shopping habits and financial goals.

More Related Guides:

- AmericanExpress com ConfirmCard Login

- Forwardline com Activate

- YourBankCard com MGMRewards

- MyProviderLink Login

Conclusion:

As we wrap up this expedition into the world of the Target Credit Card, the crux remains evident—optimized online account management is a keystone of modern finance.

By staying updated with Target Credit Card’s novelties and features, one ensures they always hold the reins of their financial journey.

Above all, the sanctity of safe and secure credit card usage remains paramount, acting as the compass guiding every transaction.