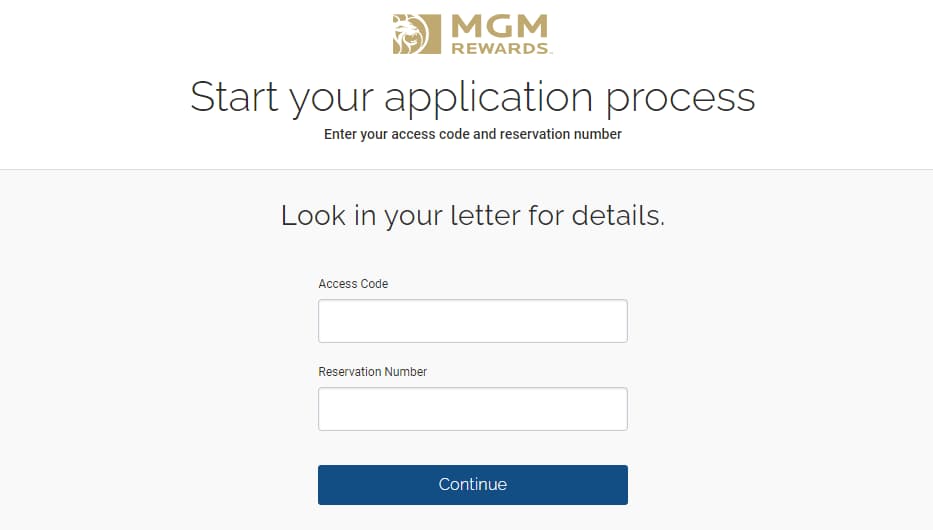

In the vast world of credit cards, the M Life Rewards MasterCard has carved its niche among discerning cardholders. Offered through the portal YourBankCard com MGMRewards, this card is not merely a medium of transaction but a gateway to a myriad of rewards and privileges.

For the uninitiated, the process to Apply for M Life Rewards MasterCard is seamless. Potential cardholders are directed to a user-centric platform where the application procedure is delineated with lucidity. As you embark on this financial journey, you’ll realize the importance of every detail, from the interest rates to the rewards accrual.

Once you receive your card, the next pivotal step is to Activate M Life Rewards MasterCard. Activation is paramount not only to commence transactions but also to ensure the security of your new financial tool. In this digitized age, such processes are optimized for efficiency, yet they retain robust security protocols.

The M Life Rewards MasterCard is more than a card; it’s a commitment to enhanced experiences, lavish rewards, and financial flexibility. So, the next time you contemplate a credit card decision, remember that with this card, you’re not just spending; you’re earning, enjoying, and evolving in your financial journey.

YourBankCard com MGMRewards

In today’s multifaceted financial landscape, the efficacy of credit card choice cannot be overstated. Like a sartorial selection, it should fit seamlessly into the user’s lifestyle.

The M Life Rewards MasterCard, with its myriad benefits, emerges as a distinguished contender in the pantheon of credit cards.

Understanding the M Life Rewards Program

But what exactly is the M Life Rewards Program? This coveted program functions as a consortium of rewarding experiences designed for its discerning clientele. A salient feature is its collaboration with premier partners and elite establishments, making it not just a card, but a ticket to a tapestry of unparalleled experiences.

And if the allure of exclusivity isn’t sufficient, the tangible benefits, ranging from discounts to special access, further accentuate its appeal.

Eligibility Criteria for Applying For M Life Rewards MasterCard Online

Here are the potential eligibility criteria for applying for the M Life Rewards MasterCard online:

- Age Requirement:

Typically, applicants must be at least 18 years old. Some states might have a higher age requirement, like 19 or 21.

- U.S. Residency:

Most credit cards, including the M Life Rewards MasterCard, usually require applicants to be legal U.S. residents.

- Valid Social Security Number (SSN):

A valid SSN is often mandatory for credit card applications to verify identity and check credit history.

- Income Requirements:

Some cards mandate a minimum income threshold or ask for details about your current income to gauge your repayment capability.

- Credit Score:

A good credit score can be crucial. The M Life Rewards MasterCard, being a rewards card, might require a fair to excellent credit score for approval.

- Existing Debt and Financial Obligations:

The card issuer might evaluate your current debts, like loans or outstanding credit card balances, to determine your financial responsibility.

- Employment Status:

Some cards may require you to be employed or have a steady source of income. This ensures you have the means to pay back any balances accrued on the card.

- History with the Bank:

If you’ve had previous accounts with the issuing bank (especially if they were in good standing), it might increase your chances of approval.

- Previous Financial Conduct:

If you’ve had a history of bankruptcy, late payments, or other financial mishaps, it could impact your eligibility.

- Verification Documents:

While not strictly a criterion, be prepared to provide or upload documents to verify your identity, address, income, and possibly more.

- No Recent Multiple Applications:

Applying for numerous credit cards in a short time can be a red flag for lenders. It’s advisable to space out credit card applications.

- Membership Requirement:

Some rewards cards are linked to specific loyalty programs or memberships. Ensure you meet any such specific criteria.

Before You Begin: Preparing Necessary Documents

As you embark on this financial journey, it’s prudent to arm yourself with pertinent identification paraphernalia. This includes not just the quintessential ID, but also robust proof of income. Recent credit history, often an overlooked facet, emerges as a linchpin, underscoring your financial diligence.

How to Apply for the M Life Rewards MasterCard at www.yourbankcard.com/mlifeapply?

Here’s the step-by-step application process for the M Life Rewards MasterCard:

- Website Access [YourBankCard com MGMRewards]:

Begin by visiting the official application website: www.yourbankcard.com/mlifeapply.

- Locate the Application Form:

On the homepage, you should find a prominent link or button leading you to the M Life Rewards MasterCard application form. Click on it.

- Personal Details:

- The application will typically begin by requesting personal information such as:

- Full name

- Date of birth

- Social Security number

- Contact details (email, phone number)

- Residential Address:

Provide your current residential address. If you have lived at your current address for less than 2 years, you might also need to supply a previous address.

- Financial Details:

- Enter relevant financial information, including:

- Employment status

- Total annual income

- Source of income

- Monthly housing obligation (like rent or mortgage)

- Security Questions:

For additional protection, you might be asked to choose and answer security questions. This helps verify your identity for future interactions or if you ever lose access to your account.

- Document Upload (if necessary):

Depending on the bank’s requirements, you might be asked to upload scanned copies or photos of certain documents, such as:

- Proof of identity (e.g., driver’s license, passport)

- Proof of income (e.g., recent pay stubs, tax returns)

- Terms and Conditions:

Before submitting your application, you’ll be presented with the terms and conditions for the M Life Rewards MasterCard. Read these carefully to understand fees, interest rates, and other crucial details.

- Review Your Application:

Before final submission, review all the details you’ve entered. Ensure that every piece of information is accurate to avoid complications or delays in the approval process.

- Submission:

Once you’re certain all information is accurate and you’ve agreed to the terms, submit your application.

- Confirmation:

After submitting, you should receive an instant acknowledgment or a confirmation message indicating that your application has been received. Some issuers might provide an instant decision, while others may take a few days.

- Await Response:

If not instantly approved, you’ll typically receive a response within a week or two. This could be an approval, a denial, or a request for additional information.

Once approved, you’ll receive your M Life Rewards MasterCard in the mail, after which you can activate it and begin enjoying its benefits. Remember, the exact process might vary slightly depending on the bank’s specific procedures.

The Wait: After Submitting Your Application at YourBankCard com MGMRewards

Post-submission, the interregnum might seem interminable. However, standard approval times are reasonably succinct. The digital age allows tracking application statuses in real time. And when the postal missive does arrive, it could be the harbinger of either approval or, albeit rarely, decline.

Possible Reasons for Application Denial

While uncommon, denials are contingent on a matrix of factors. In the face of such an eventuality, immediate steps, both introspective and actionable, are crucial. A deep dive into one’s financial topography might offer insights and a roadmap for future forays.

Understanding Your M Life Rewards MasterCard

- Activation: Before you can start using your M Life Rewards MasterCard, you’ll need to activate it. This is typically done by calling a dedicated number or using an online platform provided by the issuer.

- Card Features: Familiarize yourself with the card’s primary features, such as the interest rate, credit limit, cash advance capabilities, and any associated fees like annual or foreign transaction fees.

- Reward Point Mechanics: Understand how you earn points. This could be based on the dollar amount spent, specific categories of purchases, or transactions at partner establishments.

- Online Access: Set up your online account. This platform allows you to monitor your spending, view statements, pay bills, track and redeem rewards, and manage other card-related functionalities.

- Mobile App: Most modern credit cards, like the M Life Rewards MasterCard, come with a mobile app. Familiarize yourself with this app to manage your account on-the-go, check balances, pay bills, and even set up alerts.

- Billing Cycle: Recognize the start and end dates of your billing cycle, when your monthly statement is generated, and most importantly, when your payment is due.

- Security Features: Learn about the card’s security features, such as the CVV code on the back and any embedded chip technology. These features are designed to protect you from fraudulent transactions.

- Contact Information: Ensure you have the card issuer’s contact information handy, especially the customer service number and the hotline to report lost or stolen cards.

- Benefits and Perks: Beyond reward points, the M Life Rewards MasterCard might offer other benefits such as insurance coverage, travel perks, or special access to events. Be aware of these so you can make the most of them.

- Terms and Conditions: While it might seem tedious, it’s essential to peruse the card’s terms and conditions. This document provides critical information on fees, interest rates, reward expiration dates, and other stipulations related to card usage.

Utilizing M Life Rewards MasterCard Benefits

- Strategic Spending: Use the M Life Rewards MasterCard for daily expenses and purchases, ensuring you accumulate points consistently.

- Partnered Outlets: Prioritize spending at key partners and establishments associated with the M Life Rewards Program to gain extra points or exclusive deals.

- Special Offers: Stay updated with the card’s periodic special offers and bonuses, and plan purchases during these promotional periods for maximum benefits.

- Reward Point Redemption: Regularly check and redeem your accumulated points before they expire, ensuring you leverage every benefit available.

- Mobile App Features: Utilize the mobile app’s features to monitor and manage rewards, get updates on special promotions, and access exclusive cardholder offers.

- Travel Benefits: If the card offers travel-related benefits such as lounge access, discounted stays, or travel insurance, plan trips accordingly to fully utilize these perks.

- Financial Management: By keeping a check on the card’s balance and paying off dues promptly, you not only maintain a good credit score but also qualify for reward bonuses that some cards offer for timely payments.

- Referral Programs: Some cards offer bonus points for referring friends or family. Leverage these referral programs to earn extra points.

- Stay Updated: Regularly review communication from the card provider – newsletters, emails, or SMS alerts – to stay informed about any new partnerships, offers, or changes in the reward structure.

- Customer Service Engagement: Don’t hesitate to engage with customer service for any queries or clarifications on reward points, redemption processes, or new benefits. They can provide insights and tips on maximizing card benefits.

Frequently Asked Questions (FAQs)

- What is the M Life Rewards MasterCard?

The M Life Rewards MasterCard is a credit card that offers exclusive rewards and benefits associated with the M Life Rewards Program.

- Who can apply for the M Life Rewards MasterCard?

Eligible applicants must meet specific age, income, residency, and credit score criteria to qualify for the card.

- What kind of rewards can I expect with the M Life Rewards MasterCard?

Cardholders can earn points on purchases, which can be redeemed at partner establishments and for special discounts.

- Are there any annual fees associated with the M Life Rewards MasterCard?

Yes, the card has associated fees and interest rates, which are competitive in the credit card market.

- How do I apply for the M Life Rewards MasterCard?

You can apply online at www.yourbankcard.com/mlifeapply, where you’ll need to fill out an application form and provide the necessary documents.

- How long does it typically take to get a response after applying?

While response times can vary, applicants can typically expect to hear back within a standard approval timeframe and can track their application status online.

- If my application is declined, can I reapply?

Yes, but it’s recommended to reevaluate your financial standing and understand the reasons for denial before reapplying.

- How can I maximize the benefits of the M Life Rewards MasterCard?

By strategically using the card at partner establishments and during special offers, you can amplify the benefits and reward points earned.

- How do I protect my M Life Rewards MasterCard from potential fraud or theft?

It’s essential to recognize phishing attempts, report lost or stolen cards immediately, and regularly monitor your card activity.

- Can I manage my M Life Rewards MasterCard account online or via a mobile app?

Yes, once your card is activated, you can set up online access for card management and also familiarize yourself with the mobile app for added convenience.

Safety and Security Protocols

In an era where data is the new gold, safeguarding one’s card transcends mere financial prudence. Recognizing the insidious tentacles of phishing attempts is crucial. As cards evolve, ensuring the secure disposal of predecessors is a categorical imperative.

More Related Guides:

- AmericanExpress com ConfirmCard

- www.Macys.com/MyMacysCard

- www AspireCreditCard com Acceptance Code

- LLBean MasterCard Login

Conclusion

In summation, the M Life Rewards MasterCard from YourBankCard com MGMRewards is not just a financial instrument but an emblem of a discerning lifestyle. It beckons responsible usage, ensuring mutual growth. Staying abreast of updates ensures that one remains in the vanguard of rewards and benefits.