Applying for an Aspire Credit Card using the acceptance code is a simple and straightforward process at www aspirecreditcard com acceptance code.

By pursuing the steps summarized in this article, you can quickly take benefit of the advantages that the Aspire Credit Card offers.

In addition to the ease of application, cardholders can enjoy features such as online account management, fraud protection, and dedicated customer support.

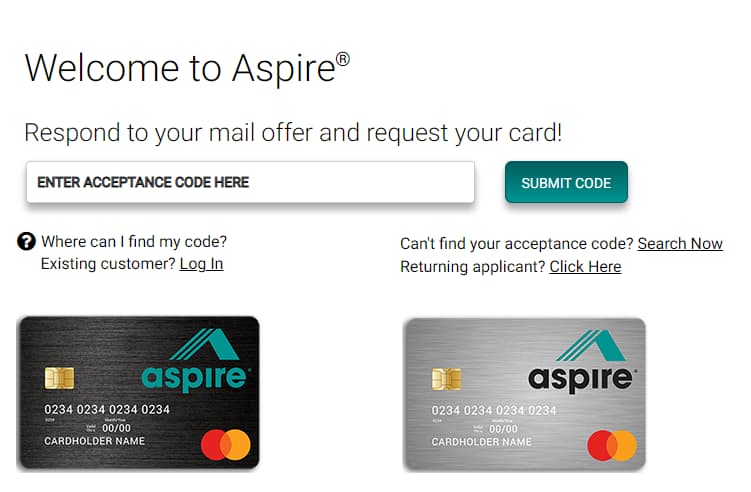

www AspireCreditCard com Acceptance Code

Are you in search of a credit card that suits your financial needs? If so, the Aspire Credit Card could be the perfect match for you.

With an effortless-to-use website and a brief application procedure, getting initiated has never been easier.

In this article, we will discuss the whole procedure of applying for an Aspire Credit Card using the acceptance code provided on www.aspirecreditcard.com. So, let’s dive in.

What is the www AspireCreditCard com Acceptance Code?

The Aspire Credit Card acceptance code is a unique, personalized code that is mailed to potential cardholders who have been pre-approved for an Aspire Credit Card.

This code is an essential part of the application process as it simplifies and expedites the approval process.

With the acceptance code in hand, you can apply for your Aspire Credit Card in just a few simple steps.

Where to find the Acceptance Code?

If you are among the pre-selected potential cardholders, you will receive an invitation in the mail containing your Aspire Credit Card acceptance code.

This code is typically a series of numbers or letters and can be found in the top right corner of your invitation letter.

Make sure to keep the acceptance code handy, as you will need it to complete your online application.

How to Apply for an Aspire Credit Card using the Acceptance Code:

- Step 1: Visit the Aspire Credit Card website

To begin your application process official site, go to www.aspirecreditcard.com or www AspireCreditCard com Acceptance Code.

The website is user-friendly and easy to navigate, making the application process straightforward.

- Step 2: Enter your Acceptance Code

On the homepage, you will find a designated field where you can input your acceptance code.

Enter the code exactly as it appears on your invitation letter, and click “Submit.”

- Step 3: Complete the Application Form

After submitting your acceptance code, you will be directed to a secure application form.

Fill in the required personal and financial information, such as your name, address, Social Security Number, and annual income.

This information will be used to verify your identity and evaluate your creditworthiness.

- Step 4: Review and Agree to the Terms and Conditions

Before submitting your application, take the time to review the Aspire Credit Card terms and conditions.

Make sure you understand the interest rates, fees, and any other applicable charges associated with the card.

If you agree to the terms, check the box indicating your consent and proceed with your application.

- Step 5: Submit your Application

After reviewing the terms and conditions, click “Submit” to finalize your application.

The Aspire Credit Card team will then evaluate your information and, if approved, you will receive your new credit card in the mail within a few weeks.

Benefits of the Aspire Credit Card:

- Easy Application Process: With the help of the acceptance code, applying for an Aspire Credit Card is quick and hassle-free.

- Access to Credit: For those with limited or poor credit history, the Aspire Credit Card can offer an opportunity to build or rebuild credit by demonstrating responsible credit usage.

- Online Account Management: Manage your account, monitor your spending, and make payments conveniently through the Aspire online portal.

- Fraud Protection: Rest easy knowing that the Aspire Credit Card comes with advanced fraud protection features to help keep your information secure.

- Customer Support: Benefit from friendly and knowledgeable customer support, available to assist you with any questions or concerns related to your Aspire Credit Card.

- Free Credit Score Access: Keep track of your credit score with free access provided to Aspire cardholders. Scanning your credit score is important for maintaining and enhancing your financial health.

- Customizable Alerts: Set up personalized alerts for transactions, payment due dates, and balance updates to help you stay on top of your account activity and manage your finances more effectively.

- Mobile App: Accessing and handling your Aspire Credit Card account is very easy with their user-friendly mobile app, unrestricted for both Android and iOS devices.

- Grace Period: Benefit from a grace period on new purchases, which allows you to avoid interest charges if you pay off your balance in full by the due date each month.

- Zero Liability Protection: In case of unauthorized transactions on your Aspire Credit Card, zero liability protection ensures that you will not be held responsible for any fraudulent charges.

Things to Assume Before Applying for an Aspire Credit Card:

While the Aspire Credit Card provides many advantages, it is important to carefully assess whether it is the proper fit for you. Here are a few aspects to think about:

- Interest Rates: As with any credit card, be mindful of the Aspire Credit Card’s interest rates, particularly if you schedule on maintaining a balance. Ensure to compare the rates with other credit card options to assure you are making the most suitable choice for your financial circumstances.

- Fees: Familiarize yourself with any fees associated with the Aspire Credit Card, such as annual fees, late payment fees, and balance transfer fees. Understanding these charges will help you avoid any surprises and manage your credit card more effectively.

- Credit Limit: Consider the credit limit offered by the Aspire Credit Card and how it aligns with your financial needs. While a higher credit limit can provide flexibility, it is crucial to use credit responsibly and not overextend yourself.

- Credit Building: If your objective is to create or rebuild your credit, assure that the Aspire Credit Card reports your account activity to the three primary credit bureaus (Equifax, Experian, and TransUnion). This reporting is important for establishing reliable credit use and enhancing your credit score.

Also Check:

Final Thoughts:

The Aspire Credit Card, with its acceptance code, provides a straightforward application process for those who have been pre-approved.

By comprehending the steps to apply and the advantages the card provides, you can make a knowledgeable conclusion about whether the Aspire Credit Card is a good choice for your financial requirements.

Remember to consider factors such as interest rates, fees, credit limits, and credit-building features when evaluating your options.

With careful planning and responsible credit usage, the Aspire Credit Card can be a valuable tool for managing your finances and achieving your financial goals.