Introducing the www.gomercury.com reservation code, a unique and essential element for obtaining the Mercury MasterCard. This invitation-only credit card is designed to help individuals with less-than-perfect credit scores build a stronger financial foundation.

By receiving a reservation code via email or mail, you become eligible to apply for this beneficial credit card, which offers a range of advantages, such as low-interest rates, no annual fees, and various rewards.

The reservation code serves as your key to access the exclusive world of Mercury MasterCard and experience its valuable features tailored to assist you in improving your credit standing.

www.GoMercury.com Reservation Code to Apply Mercury Mastercard

Mercury MasterCard, an unsecured credit card with no annual fee, is designed to help individuals with challenging credit improve their scores. The Mercury MasterCard is an excellent option for individuals looking to improve their credit scores. With no annual fee, low-interest rates, and various benefits, it’s a practical choice for everyday use.

By understanding the Mercury MasterCard login process, application steps, and payment methods, you can take full advantage of this versatile credit card.

If you have any questions or concerns, don’t hesitate to contact Mercury Credit Card Customer Service for assistance. Although Mercury typically charges high-interest rates, paying the statement balance in full each month can lead to credit-building success.

We’ll walk you through the Mercury MasterCard login process, application steps, and payment methods, and answer some frequently asked questions in this article.

Issued by First Bank & Trust of Brookings, South Dakota, and marketed by CreditShop, Mercury MasterCard boasts an A+ rating with the Better Business Bureau and offers consumer-friendly financial products and exceptional customer service.

GoMercury MasterCard Benefits:

GoMercury MasterCard might be your perfect choice If you’re in search of a pre-approved credit card. With better terms and lower interest rates, this card offers the following benefits:

- Low-interest rates and no annual fees

- 1% cashback reward for every dollar spent

- No interest on your first purchase of $20 or more

- A simple, quick application process

- Accepted wherever Visa is accepted

- Suitable for everyday purchases like groceries and gas

- No foreign transaction fees

Logging into Your Mercury Credit Card Account:

As a cardholder of Mercury Credit Card, you can manage your account, make payments, and more additional by logging into your online account. Follow these steps to sign in:

- Visit the official Mercury Credit Card website or go to mercurycards.com.

- Provide your username and password on the sign-in page.

- Tap on the “Submit/Login” button to access your account details, make payments, and more.

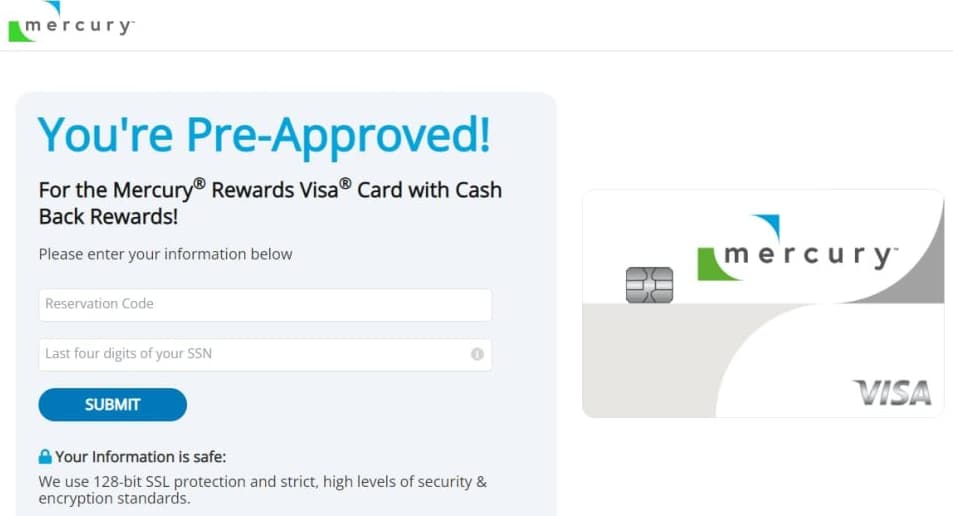

Applying for the GoMercury Credit Card via www.GoMercury.com Reservation Code:

You cannot directly apply for the Mercury MasterCard; it is only available by invitation (pre-approved) or with a reservation code from the company. Even with a credit score as low as 550, you may still qualify for the card.

Additionally, the Mercury Mobile App allows you to manage your card on the go. To apply with a pre-approved reservation code, follow these steps:

- Visit www.gomercury.com.

- Enter your reservation code and the last four digits of your social security number.

- Click the “Submit” button to apply for the Mercury Card.

- Once approved, you can expect to receive your Mercury MasterCard within 7-10 business days.

Examining for Mercury Credit Card Pre-Approval:

Before applying for a Mercury Credit Card, it’s essential to check your pre-approval status. You can do this by checking your inbox or mail for a pre-approved email containing a reservation code.

Making Mercury MasterCard Payments:

Mercury Credit Card offers multiple payment methods, including:

- Payments by mail: Send payments to Mercury Card Services, PO Box 70168, Philadelphia, PA 19176-0168, USA. Include your account’s last name and the last four digits of your account number.

- Payments by phone: Call 1-866-686-2158 to make a payment.

- AutoPay: To avoid late fees and charges, enroll in AutoPay through the official website. Your minimum amount due, statement balance, or fixed amount will be automatically paid without delay. You can cancel AutoPay up to three days before your due date.

FAQs on www.GoMercury.com Reservation Code:

-

How to access your online GoMercury account?

Visit www.mercurycards.com/cards and sign in to access your account.

-

Where is Mercury MasterCard located?

Mercury Financial Services’ headquarters is in Austin, Texas, USA.

-

How to check your Mercury Credit Card pre-approval status?

Look for a pre-approved email with a reservation code sent directly to your inbox or mail.

-

Can you apply for the GoMercury Card?

You can only apply for the Mercury MasterCard if you have a pre-approved invitation or a reservation code from the company. Even with a credit score as low as 550, you may still qualify for the card.

-

How long does it take to receive your GoMercury Card?

Once your application is approved, it typically takes 7-10 business days to receive your card in the mail.

-

Which bank issues the Mercury Card?

The Mercury Card is a product of CreditShop FS, but the Mercury MasterCard is approved and issued through First Bank & Trust.

-

What is the credit limit on a Mercury Card?

The starting credit limit for a Mercury Credit Card is $500. Your exact credit limit will be determined based on your credit score, income, and existing debts.

-

What is the minimum payment on a Mercury Credit Card?

The minimum payment for the Mercury Credit Card is $15 or 1% of your new balance plus any interest and late fees, whichever is greater. To avoid interest charges, always pay your balance in full.

-

Can you get your Mercury Card number online?

Yes, you can check your Mercury Card number, expiration date, and CVC from your online dashboard or the Mercury mobile app.

-

Does Mercury Card allow cash advances?

Yes, you can request a cash advance by contacting Mercury Customer Service at (866) 686-2158 and requesting a PIN. Then, use your Mercury Credit Card at an ATM and enter the PIN to select the “Cash Advance” option.

-

How do you transfer money from your Mercury Credit Card to your bank account?

Perform a balance transfer using your Mercury Credit Card from your online banking account or through the Mercury Mobile App. Note that Mercury’s balance transfers have an APR of 28.49% – 30.49% (V) and a transfer fee of 4% (minimum $5).

-

What are the Mercury Credit Card fees?

The Mercury Credit Card fees vary depending on your credit standing. Current charges include an Annual Fee: of $0 – $79, a Cash Advance Fee: of 5% (minimum $10), a Foreign Fee: of 0% – 3%, a Balance Transfer Fee: of 4% (minimum $5), and Max Late Fee: $41.

-

How do you pay your Mercury Credit Card bill?

You can pay your Mercury Credit Card bill by logging in to your online account, setting up Auto-Pay to avoid late fees, or contacting the Mercury Helpdesk over the phone at (866) 686-2158. You can also pay as a guest or use the Mercury Credit Card app for iOS and Android.

-

Does Mercury Credit Card allow authorized users?

Yes, you can add authorized users by signing in to your online account and clicking on the “Services” tab or by calling Mercury Credit Card Customer Service at (866) 686-2158.

Also Check:

- AmericanExpress.com/ConfirmCard

- PrepaidGiftBalance.com Login

- MyFirstPremierBankCard Login

- CCSPayment com

Conclusion:

The www.gomercury.com reservation code is a crucial component for those seeking to apply for the Mercury MasterCard. This exclusive invitation opens the door to a wide array of financial benefits, including credit-building opportunities, low-interest rates, and valuable rewards.

As a card tailored to help individuals with challenging credit, the Mercury MasterCard and its reservation code system ensure that the right audience is targeted and supported in their journey to achieve better financial health.

By leveraging the power of the Mercury MasterCard, cardholders can work towards a brighter financial future and enjoy the numerous perks this card has to offer.