Kubota Credit USA Login – For those who’ve invested in Kubota machinery or vehicles through Kubota Credit Corporation, here’s your comprehensive guide to managing your monthly payments, whether online or via mail.

Need help? We’ve also included details on how to reach out to Kubota Credit’s dedicated consumer service team.

Kubota Credit USA Login

Established in 1982 and headquartered in Torrance, California, Kubota Credit Corporation USA operates as a proud subsidiary of Kubota Tractor Corporation.

Dedicated to providing avant-garde financing solutions in the USA, the corporation pioneers contract programs and equipment purchase finance. These distinguished offerings are disseminated through an expansive national dealer network.

But what truly sets Kubota apart?

- Competitive Edge: Kubota is not just about machinery; it’s about best-in-class services that offer its users an unparalleled competitive advantage.

- Alluring Interest Rates: Beneficial rates that cater to the needs of the consumer.

- Swift Credit Approvals: No more long waits; get approvals in a flash.

- Expert Consultation: Engage with our erudite specialists for informed decisions.

- Flexible Payment Options: Seamlessly navigate through our myriad payment methods and programs tailored for ease.

Choose Kubota, where excellence meets functionality.

What is KubotaCreditUSA?

Kubota Credit Corporation, U.S.A. (KCC) stands at the forefront of financial services, tailoring finance solutions for a diverse range of Kubota products. From sleek mowers and robust tractors to versatile machinery, KCC ensures you have the financial backing to secure your desired equipment.

Dive into the array of financing avenues provided by KCC: be it leases, loans, or flexible installment plans. Understandably, the specifics of these options — terms and rates — oscillate based on an individual’s credit profile and the chosen Kubota product.

Keen on exploring KCC’s financing? You’ve got two straightforward routes:

- Walk into an authorized Kubota dealership: Let their experts guide you.

- Digitally submit an application: Perfect for those who prefer online convenience.

Ready to start? Gather these essentials:

- Personal particulars: Think name, residential address, and Social Security number.

- Financial snapshot: Your income metrics and existing financial commitments.

Once you’ve dispatched your application into KCC’s realm, they’ll meticulously peruse your credit dossier. Post-review, if all aligns, they’ll greenlight your loan. What follows? A well-structured loan agreement, crystallizing the terms of your newly acquired financial support. Happy Kubota shopping!

KubotaCreditUSA Account Features

- A payment reminder alert.

- You’ll receive an alert when your account is overdue.

- Kubota frequently presents exclusive offers to its members.

- Should a specific offer catch your eye, you can opt for updates on it.

KubotaCreditUSA Login Requirements:

- Kubota Credit USA Website Link

- Valid User ID and Password for Kubota Credit US access.

- Web browser requirement.

- Desktop, smartphone, or tablet with stable internet connectivity.

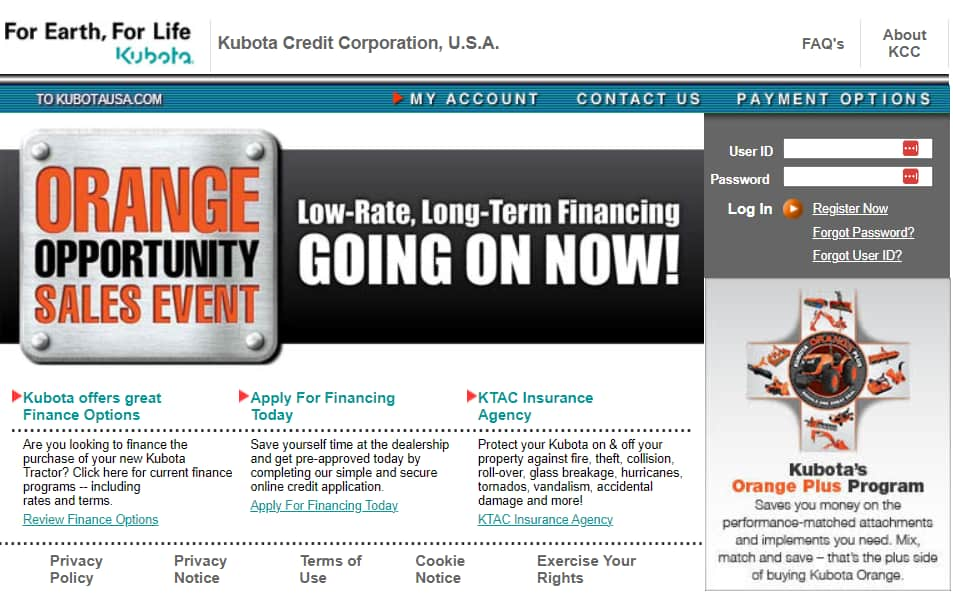

How to Login to Kubota Credit USA Account?

Here’s a straightforward guide to logging into Kubota Credit USA at www.kubotacreditusa.com:

- Navigate to the official Kubota Credit USA website: www.kubotacreditusa.com.

- Input your User ID in the provided space.

- Proceed to fill in your Password in the subsequent field.

- Finally, hit the ‘LOGIN’ button and dive into your account.

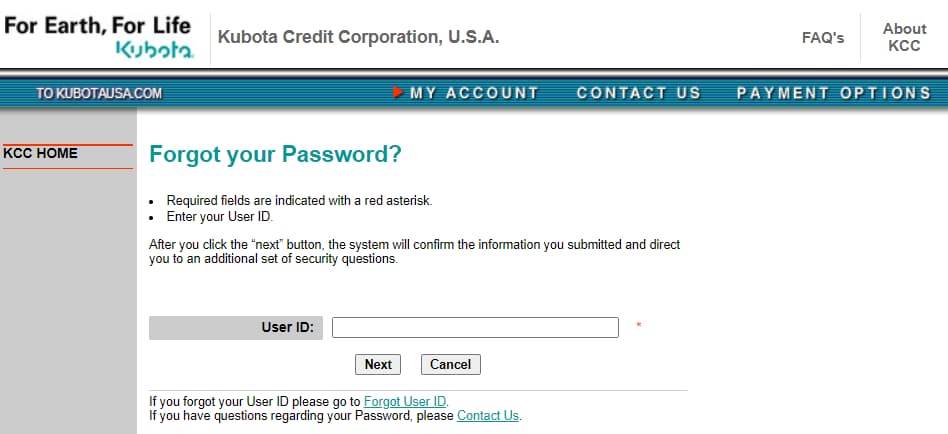

How to Reset Kubota Credit USA Login Password at www.kubotacreditusa.com?

Forgot your password on the Kubota Credit USA login page? No worries! Here’s a quick guide to reset it:

- Launch your browser and head to Kubota Credit USA’s official login page: www.kubotacreditusa.com.

- Spot the “Forgot Password?” link? Click on it. (Refer to the image if needed.)

- Enter your User ID in the designated field.

- Click the ‘Next’ button and simply follow the on-screen instructions to set up a new password.

Kubota Credit USA Payment Options:

Kubota Credit USA Payment Address:

Residing in Alaska, Arizona, California, Hawaii, Idaho, Utah, Montana, Nevada, Oregon, Washington, or Wyoming? Direct your Kubota Credit USA payments to:

- Kubota Credit Corporation, U.S.A

P.O. Box 894717

Los Angeles, CA 90189-4717

For those based in other regions, here’s your payment destination:

- Kubota Credit Corporation, U.S.A

P.O. Box 0559

Carol Stream, IL 60132-0559

Pay Online:

Accessing online payment has never been more seamless. With ‘Pay Online’, users can conveniently set up either recurring or one-time transactions anytime, any day of the week.

For those looking to establish an online account, keep your account details handy. Specifically, you’ll require the primary customer’s account digit and the terminal quartet of their social security or tax ID number. Dive in and experience effortless online financial management.

Pay by Phone:

Want to clear that pending bill right from your bank account? Just dial into our Customer Information System at 1-888-465-8268 (1-888-GO-KUBOTA).

Available round-the-clock, every day of the week, this service ensures your transactions are smooth and swift. When you call in, be ready with your account specifics and the concluding four numerals of the primary holder’s social security or tax ID number.

Rest assured, any payments made via phone will be reflected in your account on that very day. Dive in for hassle-free financial interactions!

Direct Payment Plan

Unlock the effortless way to manage your dues with the Direct Payment Plan. This plan ensures that your scheduled payments are automatically withdrawn from your bank account, offering a slew of advantages:

- Bid farewell to postage expenses.

- No need to jot down checks.

Your payments will be siphoned from your bank account either on the due date or the following working day if the due date falls on an off day. Remember, any dues before your initiation date should still be settled via check, online, or over the phone.

Getting on board with the Direct Payment Plan? It’s straightforward. Just fetch, fill out the enrollment sheet, and dispatch it back through mail, electronic mail, or a swift fax. Dive into seamless financial management today!

FAQs on Kubota Credit USA Login

- How do I make my Kubota payment?

Payments can typically be made online via the Kubota Credit USA website or by mailing a check to the address specified on your billing statement. You can also consider setting up automatic payments from your bank account.

- What is the phone number for Kubota credit payoff?

For accurate and up-to-date information on Kubota credit payoffs, it’s recommended to visit the Kubota Credit USA website or refer to the contact information provided on your billing statement.

- What bank does Kubota use?

Kubota primarily finances through their own financing arm, Kubota Credit Corporation, U.S.A. However, they might have partnerships with other local banks and financial institutions for certain programs.

- How do I create a Kubota account?

To create a Kubota account, visit the Kubota Credit USA website and navigate to the registration or sign-up section. You’ll be prompted to provide the necessary details and set up login credentials.

- Does Kubota have an app?

As of my last training data in September 2021, Kubota had not released an official app. However, they may have updates or new developments, so it’s a good idea to check the official website or app stores for any recent releases.

- How long can you finance a Kubota tractor for?

The financing period for a Kubota tractor can vary based on the model, price, and credit score. Typically, terms can range from 12 months to several years. It’s best to check with Kubota Credit USA or your local dealer for specific terms.

- What credit score do I need to finance a tractor?

The required credit score can vary based on the financing institution, the amount you intend to finance, and the type of tractor. Generally, a higher credit score may fetch better interest rates and terms. It’s advisable to consult directly with the financing provider for specifics.

- Is 500 hours a lot for a Kubota tractor?

In the world of tractors, 500 hours isn’t particularly high. However, the condition and maintenance of the tractor play a significant role. A well-maintained Kubota tractor can run efficiently for several thousand hours.

- What is the best type of loan for a tractor?

The ideal loan type can vary based on your financial situation and needs. Common options include installment loans, equipment financing, or agricultural loans. Each has its own benefits, so it’s crucial to discuss with a financial advisor or loan officer to determine the best fit for you.

Kubota Credit USA Contact Details:

- Phone: 1-888-GO-KUBOTA, (888) 465-8268

- Address: 4400 Amon Carter Blvd, Ste. 100. Ft Worth TX 76155

- Hours: Monday-Friday 7:30 am to 7:30 pm

Useful Links

- Kubota Credit USA Login official website: Click Here

- Kubota Global Official Website: Click Here

- Kubota Farm Equipment site: www.kubotausa.com

Kubota Credit USA Social Media Channels:

- Not Available Officially

About Kubota Credit Corporation

Established with an unwavering commitment to supporting agricultural and construction sectors, Kubota Credit Corporation (KCC) has become the epitome of reliability and trustworthiness in the world of equipment financing. As the financial arm of the globally-recognized Kubota Tractor Corporation, KCC has been instrumental in empowering thousands of businesses and individuals to procure the machinery they need, when they need it.

A Brief History

Founded in Japan in 1890, Kubota Corporation made its mark as a premier manufacturer of heavy machinery, tractors, and other industrial equipment. Recognizing the ever-growing needs of the North American market, Kubota expanded its operations across the shores, laying the foundation for the Kubota Credit Corporation in the 1980s.

Headquartered in Torrance, California, KCC embarked on a mission to ease the financial burdens associated with acquiring high-quality machinery, thereby allowing customers to focus more on productivity and less on procurement concerns.

Driving Innovation in Financial Solutions

Over the decades, KCC’s suite of financial services has evolved in tandem with market demands. Today, their offerings are not restricted to simple loans or leases. Instead, they’ve diversified into a plethora of finance programs tailored for different types of equipment, varied customer profiles, and specific project requirements. From farmers seeking to upgrade their tractors to construction businesses wanting to add new machinery to their fleet, KCC offers a customized solution for every need.

Their innovative approach doesn’t end with a variety of finance solutions. KCC continuously adopts cutting-edge technology to simplify loan application processes, fast-track approval times, and provide clear, transparent communication to their clientele.

This convergence of finance and technology ensures that customers spend minimal time on paperwork and maximum time harnessing the power of their new equipment.

Commitment to Excellence

The success of KCC doesn’t merely hinge on its extensive portfolio of financial services. At its core, the company’s unwavering dedication to customer service sets it apart. Understanding that purchasing heavy machinery is a significant investment, KCC’s team of knowledgeable specialists ensures that every client feels supported throughout their financial journey.

Furthermore, competitive interest rates, speedy credit approvals, and flexible payment methods offered by KCC demonstrate their genuine commitment to facilitating growth and innovation in the sectors they serve. By providing attractive financial packages, they’ve played an integral role in fostering the success of numerous ventures, both big and small.

An Eye on the Future

As the world strides into a future dominated by technological advancements, the importance of state-of-the-art machinery in the agriculture and construction sectors cannot be overstated. Recognizing this, KCC continually refines its strategies and services to stay in line with the dynamic shifts of the global market.

Environmental concerns are also driving change in the machinery world. Kubota, KCC’s parent company, is increasingly focusing on developing equipment that’s not just efficient but also eco-friendly.

This ethos trickles down to KCC’s financial solutions, as they strive to provide incentives for customers looking to make environmentally-conscious purchasing decisions.

Top 10 Kubota Credit Corporation Alternatives in USA

- John Deere Financial: Renowned for its financial services tailored for customers purchasing John Deere equipment, ranging from tractors to forestry machines.

- AGCO Finance: Collaborating with leading global finance company DLL, AGCO Finance specializes in providing comprehensive financing solutions for AGCO machinery.

- Mahindra Finance USA: A subsidiary of the Mahindra Group, it offers retail financing options for consumers and dealers of Mahindra tractors and utility vehicles.

- CNH Industrial Capital: The financial arm of CNH Industrial, this entity provides an array of financial products and services to support the Case and New Holland agricultural and construction equipment brands.

- Caterpillar Financial Services Corporation (Cat Financial): As the financial arm of Caterpillar Inc., Cat Financial offers financial service excellence to customers and dealers for a complete line of Cat machinery and engines.

- Wells Fargo Equipment Finance: A division of the leading banking institution Wells Fargo, it provides competitive equipment loans and leases that are tailored to meet the unique needs of different industries.

- Farm Credit Services of America: A customer-owned financial cooperative, it provides credit and insurance services to farmers, ranchers, and other rural customers in the U.S. Midwest.

- PNC Equipment Finance: A part of PNC Financial Services Group, this organization provides a comprehensive suite of leasing and financing solutions for equipment.

- Ford Credit Commercial Lending: Offering financing for commercial vehicles, this division of Ford Credit can be a potential alternative for businesses needing vehicles rather than heavy machinery.

- M&T Equipment Finance: A division of M&T Bank, it offers equipment financing options tailored for a variety of industries, including agriculture and construction.

KubotaCreditUSA Review – 2023

In the constantly evolving world of equipment financing, KubotaCreditUSA has firmly established its foothold as one of the go-to solutions for those in need of financial assistance for Kubota products. Established as an extension of the renowned Kubota brand, this financial arm in 2023 continues to uphold its reputation for offering seamless, reliable, and customer-centric services.

Diving into its digital interface, the ease of navigation is commendable. The user-friendly design is complemented by quick online application processes, enabling customers to save valuable time. Moreover, the transparency in loan terms, interest rates, and the variety of financial packages offered is particularly notable, catering to a broad spectrum of client needs.

Customer service remains one of the shining stars in KubotaCreditUSA’s portfolio. The knowledgeable specialists on board provide not just transactional assistance but genuinely guide clients through their financial journey. This approach creates a sense of trust and reliability, crucial in the realm of finance.

However, it’s worth noting that while KubotaCreditUSA offers competitive rates, it’s always wise for potential borrowers to cross-compare with other financing alternatives available in the market.

In summary, for those eyeing Kubota products and seeking a hassle-free financing solution, KubotaCreditUSA, as of 2023, stands as a solid and dependable choice.

More Useful Guides:

- Accept.CreditOneBank.com Approval Code

- Kohls Credit Card Login

- Target Credit Card Login

- YourBankCard com MGMRewards

Conclusion:

Wrapping up the insights on Kubota Credit USA Login at www.kubotacreditusa.com. Trust this guide shed light on your path! Should any queries or hiccups arise regarding the Kubota Credit USA Login, don’t hesitate to drop a comment.

Always here to assist. Cheers!